FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Descrição

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

2023-2024 Tax Brackets & Federal Income Tax Rates

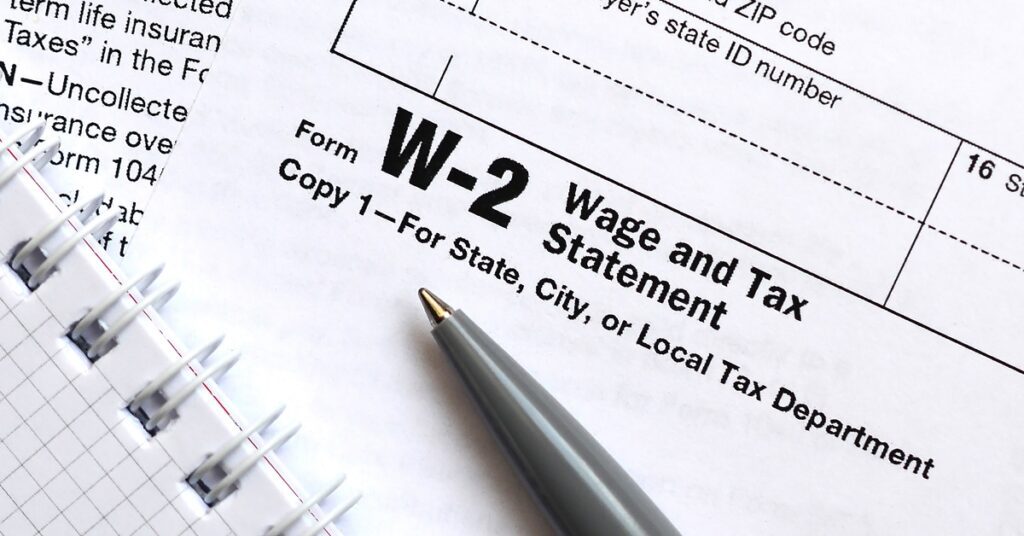

What is the 1099 and W2 Deadline This Year?

A guide to small business tax brackets in 2022-2023

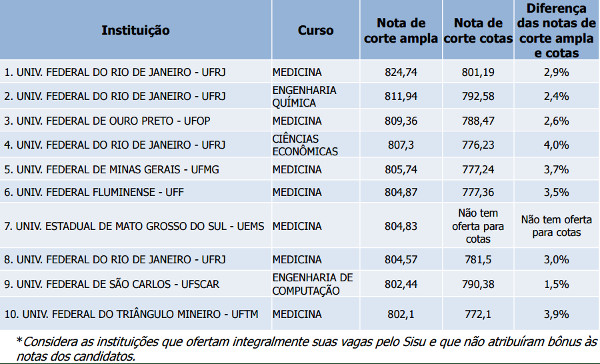

Maximum Taxable Income Amount For Social Security Tax (FICA)

Attention High Earners: Here's the Maximum Social Security Tax for

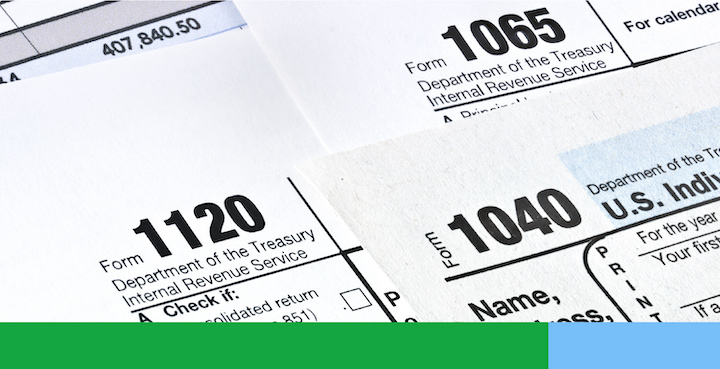

Small Business Tax Forms

Maximum Taxable Income Amount For Social Security Tax (FICA)

A guide to small business tax brackets in 2022-2023

FICA Tax in 2022-2023: What Small Businesses Need to Know

Employers: The Social Security Wage Base is Increasing in 2022 - BGM

Social Security and Medicare Taxes in 2023: What's New and What's

Social Security wage base is $160,200 in 2023, meaning more FICA

2023 Social Security Changes - Milwaukee Courier Weekly Newspaper

Tax filing tips: What to know to help get biggest refund on 2022 taxes

2024 State Business Tax Climate Index

de

por adulto (o preço varia de acordo com o tamanho do grupo)