How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Avoid Self Employment Tax - S Corp Election - Reduce SE Tax - WCG CPAs & Advisors

S Corp vs LLC: Selecting a Business Structure — SLATE ACCOUNTING + TECHNOLOGY

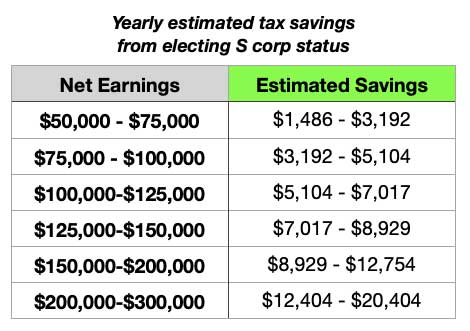

Here's How Much You'll Save In Taxes With an S Corp (Hint: It's a LOT)

Filing S Corp Taxes 101 — How to File S Corp Taxes

CORPORATION: Calculating My Solo 401k contributions for a Corporation - My Solo 401k Financial

How a CRNA S Corporation Can Reduce Your FICA Self-Employment Taxes

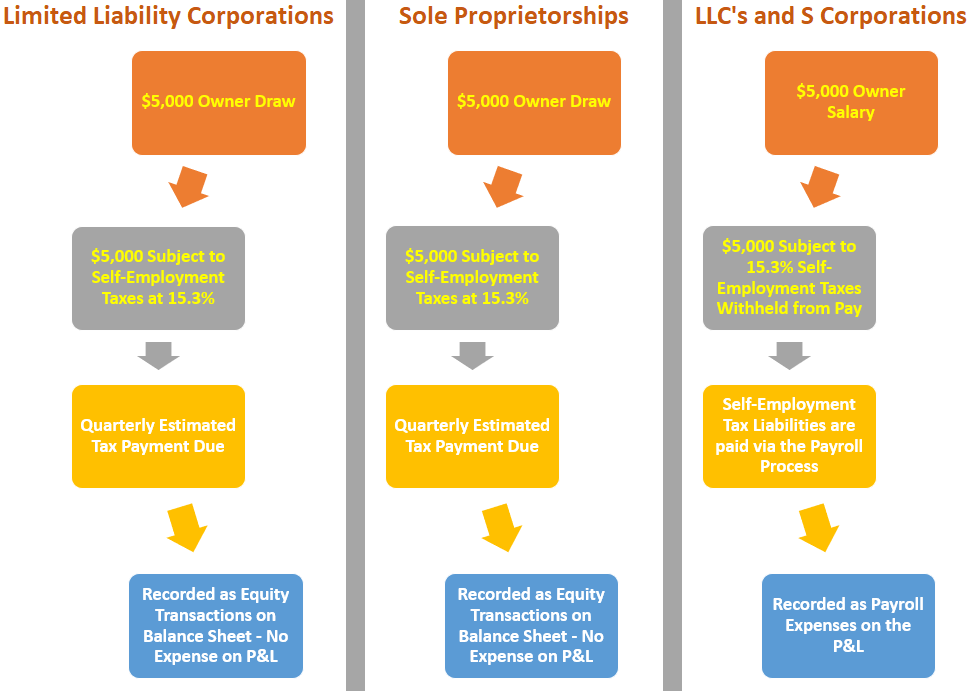

Understand How Small Business Owners Pay Themselves & Track Self-Employment Tax Liabilities - Lend A Hand Accounting

The ultimate guide to self-employed tax deductions

Reduce self-employment taxes with a corporation or LLC

Optimal choice of entity for the QBI deduction

What Is An S Corp?

S Corp Tax Savings Calculator

de

por adulto (o preço varia de acordo com o tamanho do grupo)