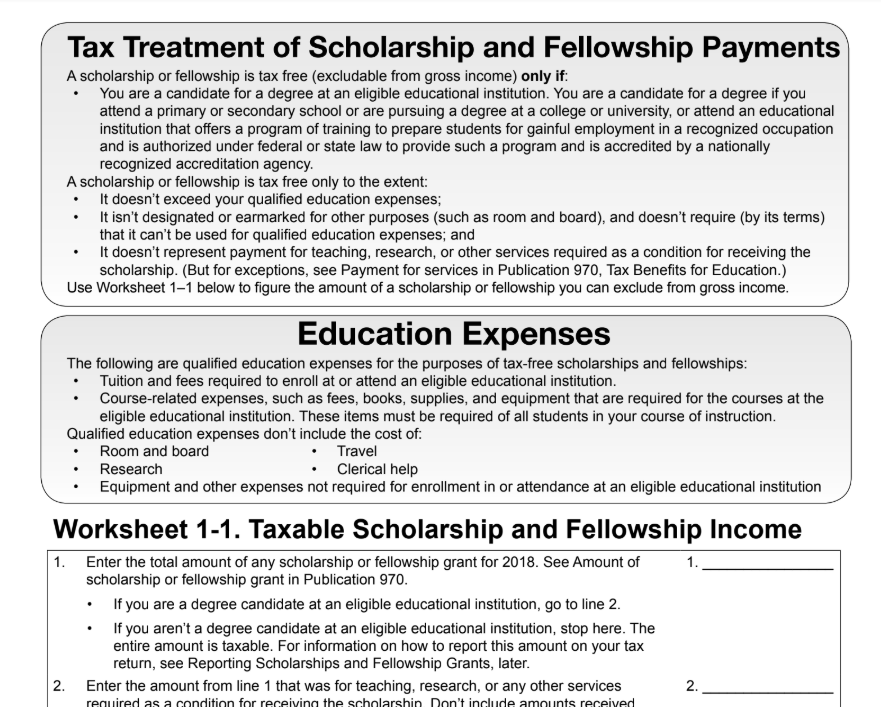

Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

Publication 970 - Introductory Material Future Developments What's New Reminders

Tax Credit – 1098-T, Student Financial Services

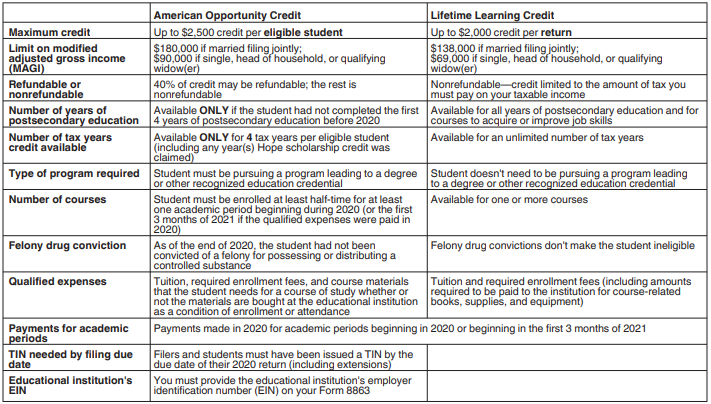

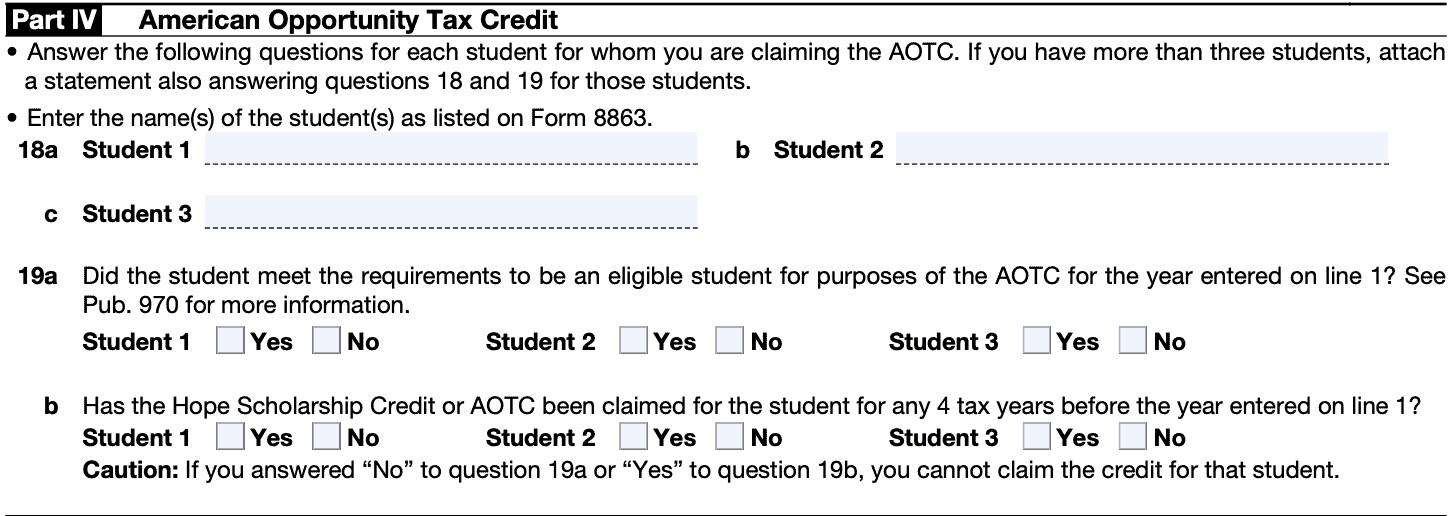

1040 - American Opportunity and Lifetime Learning Credits (1098T)

:max_bytes(150000):strip_icc()/glasses-4704055_1920-8b09e138284e401587985972c819e2d5.jpg)

IRS Publication 970: Tax Benefits for Education Overview

Sher's Tax & Accounting LLC

IRS Form 8862 Instructions

Education Credits

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

Solved Description Joanna Gaynes was an amazing high school

Are VA Education Benefits Taxable? - Military Supportive Colleges

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

How College 529 Savings Account Withdrawals Are Taxed & Why You May NOT Want to Use a 529 Plan Altogether - Lifetime Paradigm

Maximizing the higher education tax credits - Journal of Accountancy

Publication 970 (2022), Tax Benefits for Education

Tax Resources

All the Money-Smart Freebies - Financial Freedom Evolution

de

por adulto (o preço varia de acordo com o tamanho do grupo)