What is FICA Tax? - The TurboTax Blog

Por um escritor misterioso

Descrição

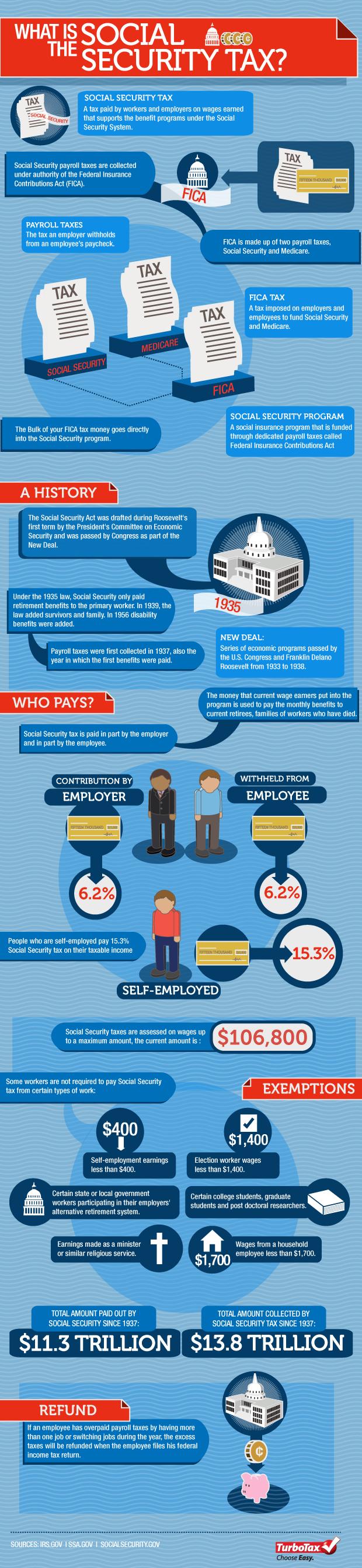

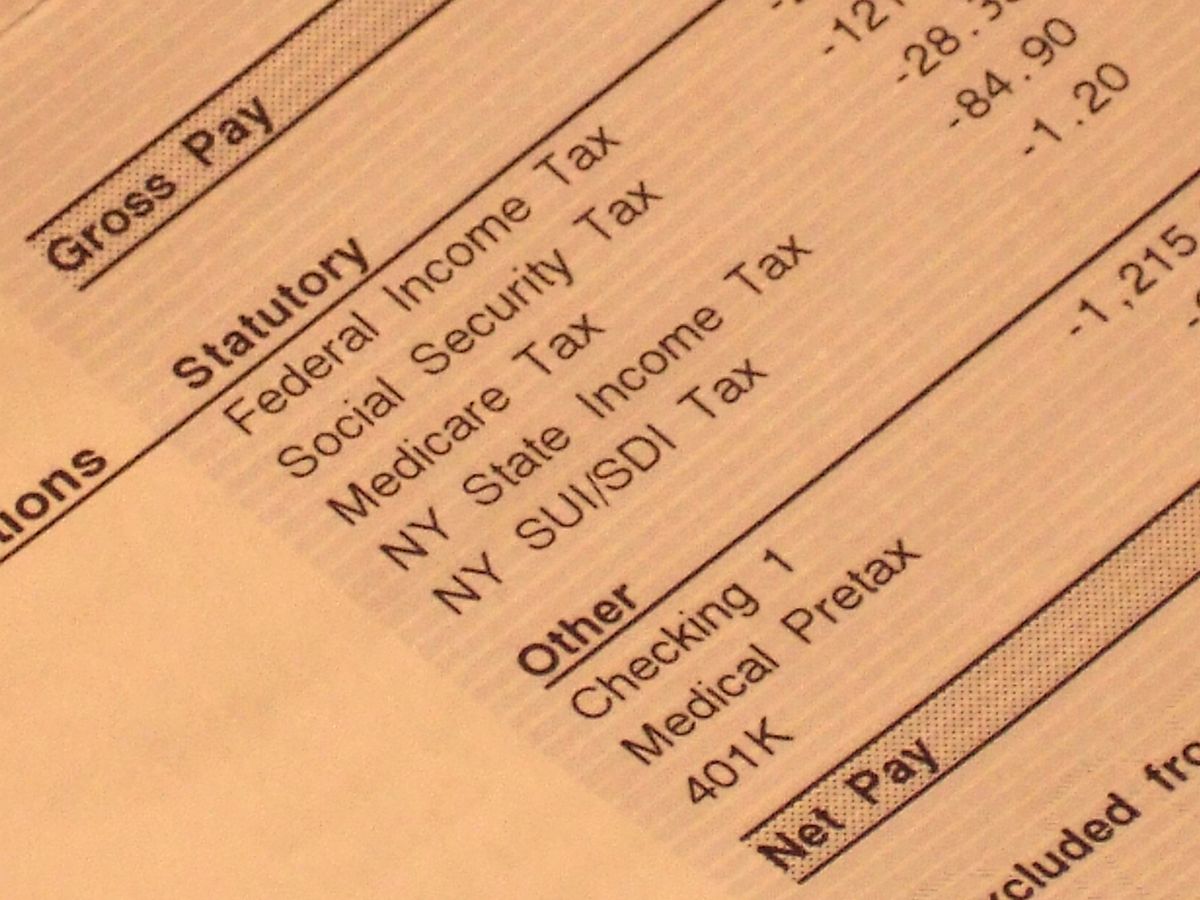

Quick Answer: FICA is a payroll tax on earned income that covers a 6.2% Social Security tax and a 1.45% Medicare tax. If you’ve watched “Friends,” you can probably relate to Rachel opening her first paycheck and asking, “Who’s FICA? Why’s he getting all my money?” If you asked, you were probably told it was

What is the Social Security Tax?

Save Money. Ace Tax Season. - Members First Credit Union

FICA Tax Exemption for Nonresident Aliens Explained

Intuit TurboTax 2023 (Tax Year 2022) Review

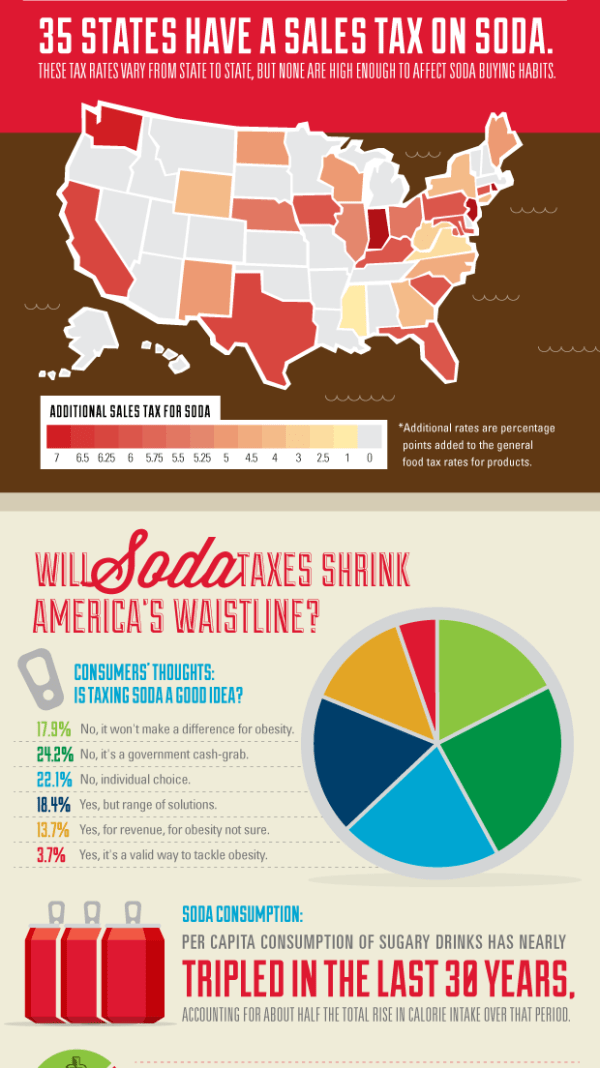

Taxes On America's Favorite Beverage: Soda - The TurboTax Blog

Taxes Archives - Page 2 of 3 - The TurboTax Blog

You May Still Be Eligible To File Your Taxes for Free! - The

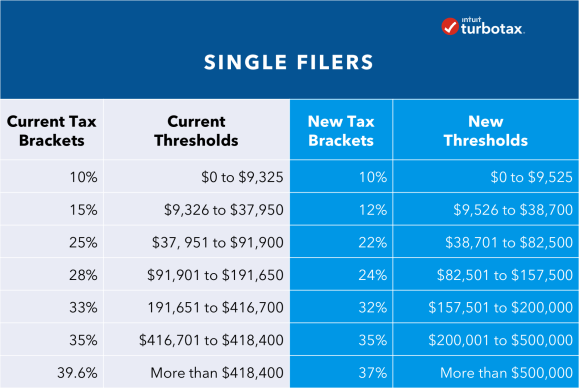

Tax Reform Bill Passed: Here's What It Means for You - The

What is FICA tax?

Show Us How You #TurboTaxAndRelax for a Chance to Win $10,000

TurboTax Answers Most Commonly Asked Tax Questions - The TurboTax Blog

How Much are Medicare Deductions for the Self-Employed? - The

Withholding FICA Tax on Nonresident employees and Foreign Workers

de

por adulto (o preço varia de acordo com o tamanho do grupo)