What it means: COVID-19 Deferral of Employee FICA Tax

Por um escritor misterioso

Descrição

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

IRS Issues Guidance for Executive Order on Payroll Tax Deferral - Sikich LLP

Questions Remain After IRS Rolls Out Guidance On Payroll Tax Deferral

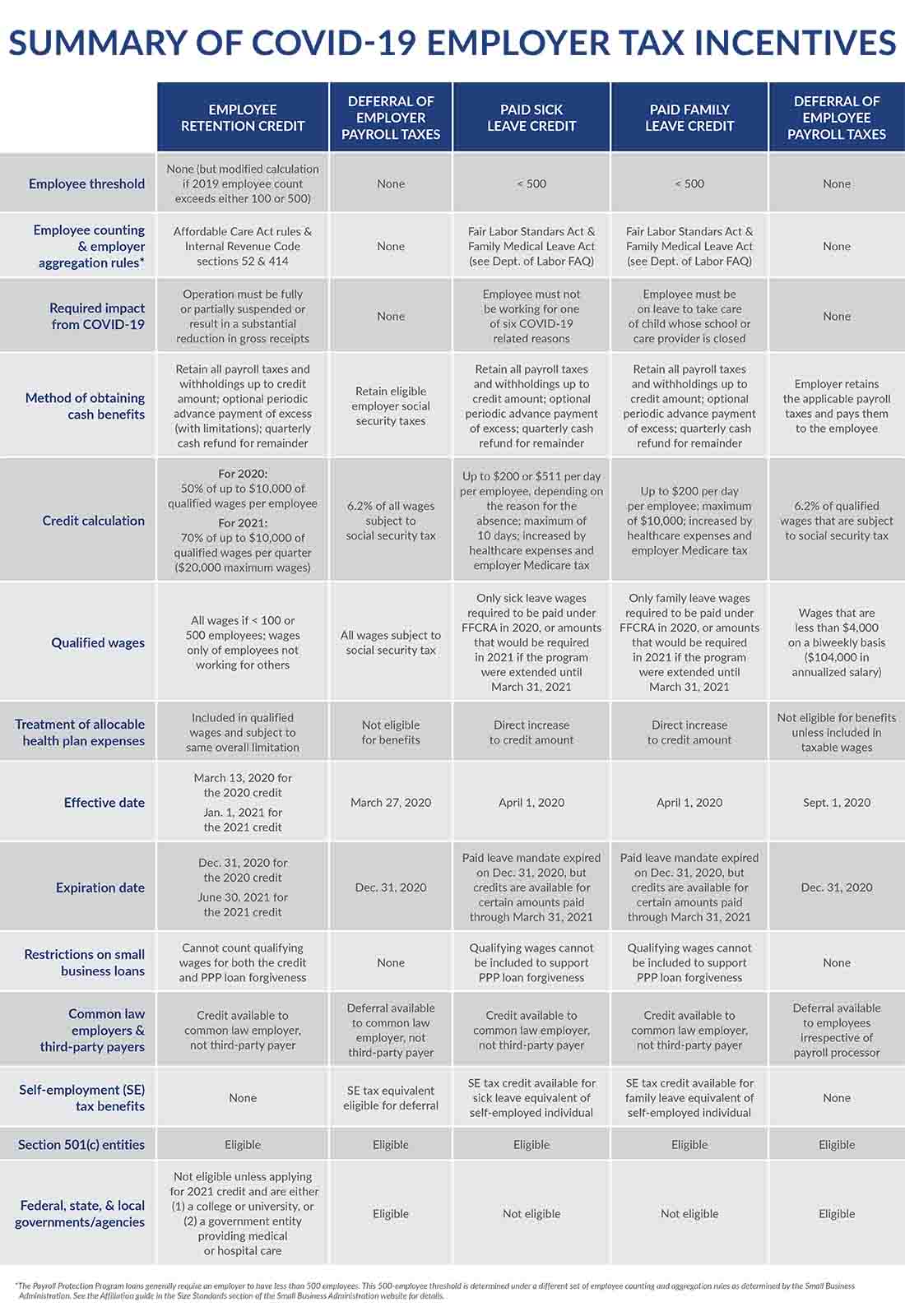

Comparison of COVID-19 employer tax incentives, Our Insights

IRS Updated Form 941 for COVID-19 Related Employment Tax Credits

Customer Support during COVID-19

Business Owners: Is the Temporary Deferral of Employee Payroll Tax Worth It? – Henssler Financial

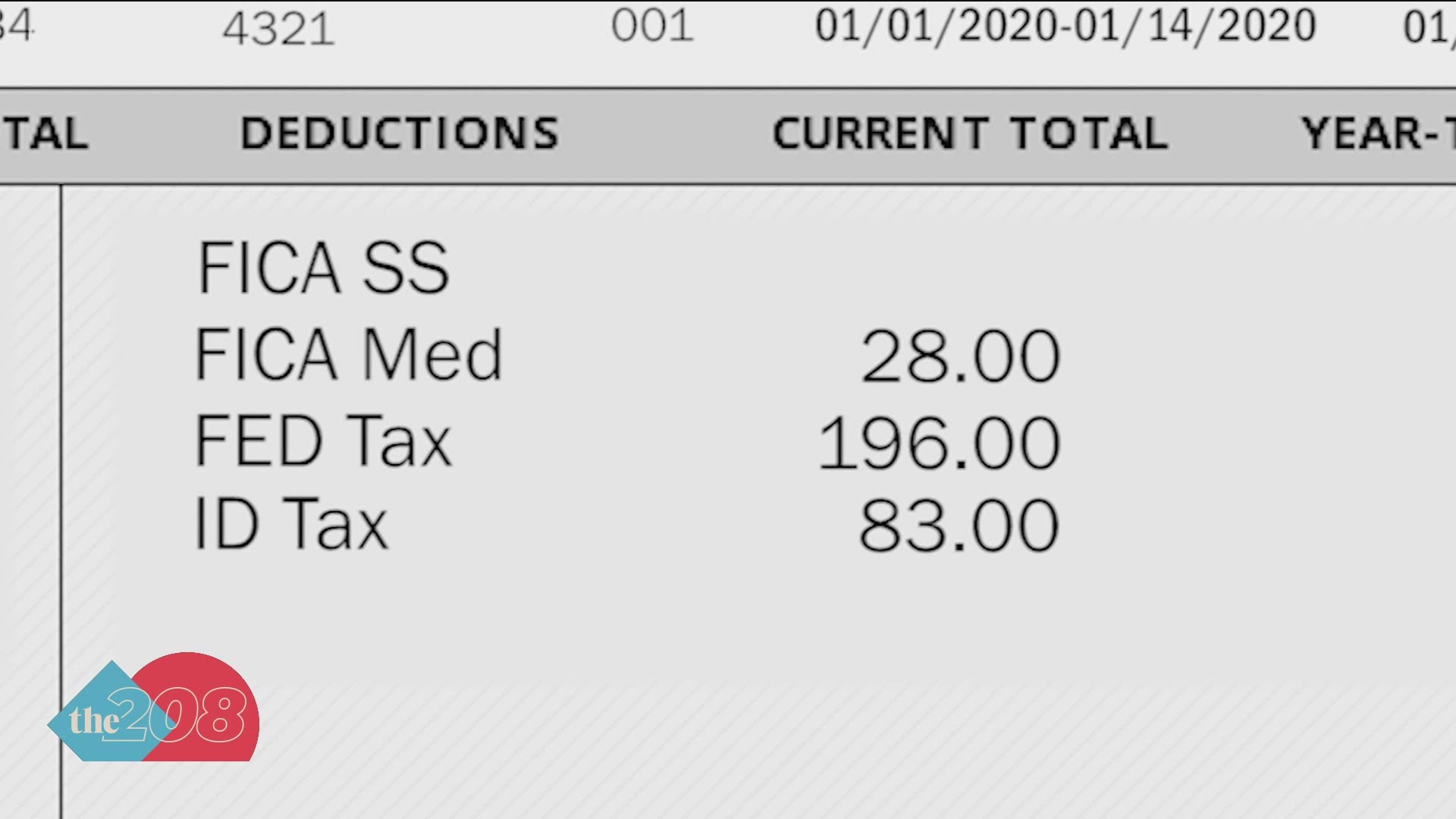

Interested in the payroll tax deferral? Here's how it will work

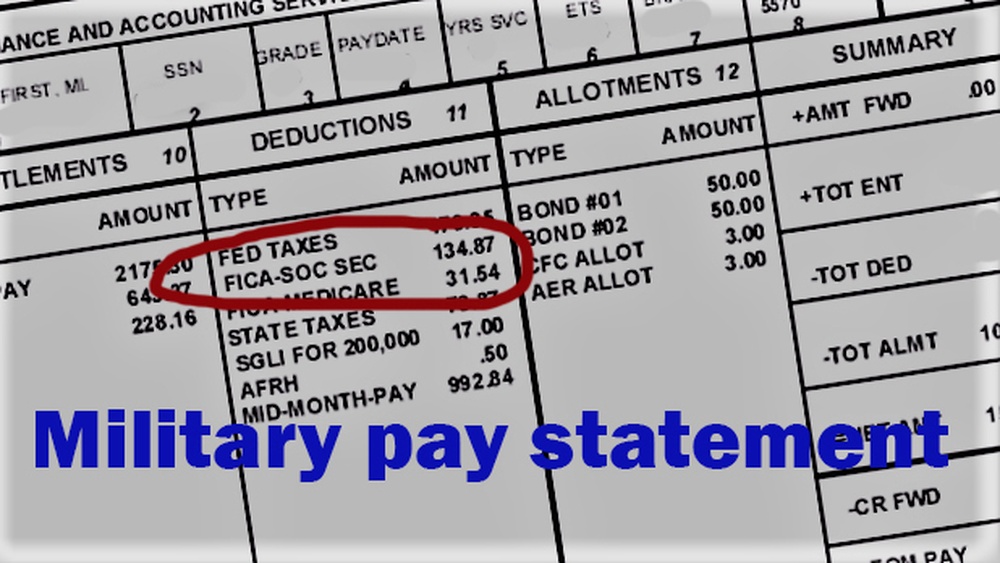

DVIDS - News - Social Security payroll tax deferral begins for DOD employees

:max_bytes(150000):strip_icc()/work-57910b405f9b58cdf3c601e9.jpg)

Employer Payroll Tax Deferral Provision: What it is, How it Works

de

por adulto (o preço varia de acordo com o tamanho do grupo)